Whenever you are thinking about refinancing your house mortgage, this task-by-step guide shows you what to expect and how to navigate the procedure.

Having rates of interest in the a virtually all-go out lowest around the Australian continent, number numbers of people are employing the ability to find far more cost-effective otherwise flexible selling to their lenders step one . Just what, precisely, does it mean so you’re able to re-finance a home, and if would it be helpful?

Refinancing can mean talking-to your existing seller to renegotiate the plan with these people (an inside refinance), nevertheless have a tendency to means using a separate bank so you can safe a much better deal (an external re-finance).

There are plenty of reasons to imagine refinancing, of saving money by reducing the monthly costs, to help you decreasing the term of the financing, so you’re able to opening mortgage features you to definitely finest work for you, and you will merging most other bills (like personal loans otherwise auto loans) in one all the way down rates.

Start by having fun with a beneficial re-finance calculator locate a concept of what you could rescue by the refinancing. Up coming crunch the newest wide variety to your a home loan review calculator to compare your financing for other analogy funds, observe what would work best for you.

Also, it is a good idea to envision if the financial advantages away from reworking the mortgage outweigh any potential charge and you can costs.

There are lots of reasons to believe refinancing, from spending less in order to consolidating almost every other expense at the same lower price.

Yes, a corner off refinancing is about saving cash on the longterm through getting a much better price on your mortgage. But before you create the alteration, it is advisable to confirm you’ll get everything else you need, as well. Speaking of a number of the mortgage have that Amp has the benefit of according to the product; almost every other lenders might bring comparable otherwise different alternatives:

- The fresh facility to make a lot more money rather than punishment to the variable-rates financing

- Several mortgage breaks (between repaired and you will changeable) at the no extra pricing

- The capacity to redraw to the variable home loans

- Online and mobile financial

- No yearly bundle charge

- No monthly membership government charges

- Like the manner in which you pay-off by the mortgage with prominent and you can attention, or desire merely money

- Make more repayments towards the fund

- Financial help inside valuation charges

Before you could score also caught up compared-shopping, be also conscious you could encounter one another short-identity and continuing fees when refinancing your residence financing. These may tend to be:

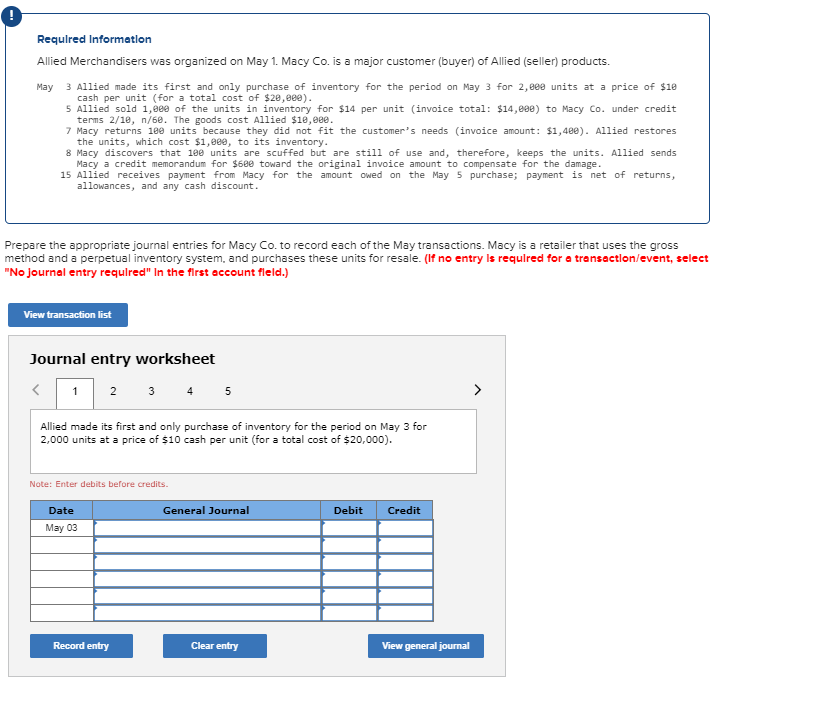

If you have opposed home loan offerings on the market, work at the newest sums, and you will figured the many benefits of refinancing surpass the expenses, the next phase is to put in a software which have a beneficial brand new financial.

A file number to have refinancing their financial

When it comes to refinancing your property mortgage with a brand new lender, it pays become waiting. A lender will generally like to see:

Additionally, you will must complete a form, that can require some of one’s above facts as well as additional information concerning your dependents, assets and you will obligations, the purpose of the mortgage, the mortgage amount you may be seeking to along with your monthly expenditures. Then you’ll definitely need likewise have knowledge in regards to the assets in itself, including the identity deeds.

Ideas on how to get-off your current mortgage

The next thing is to do a home loan Release Expert Mode along with your current financial really loan providers keeps this type of on the internet. This may ask you about your assets, the main people inside, therefore the financing account details. It is going to provide you with home elevators https://paydayloanalabama.com/brook-highland/ bank charges and you can people government charge might face once you finalise the leave software.

Leaving your existing mortgage and trying to get an alternate that are going to be an occasion-sipping techniques. An amp mortgage specialist may take the stress regarding refinancing and you will speed up the whole process of app by liaising along with your latest lender to determine your leave fees, complete the discharge setting and you will secure your property’s name deeds.