Our very https://paydayloanalabama.com/calvert/ own selection of the best disaster credit networks is sold with loan providers who can present you with financing because small just like the twenty four hours.

Minimal credit rating expected to get that loan may differ for every single bank. Really financial institutions, for example, need the very least credit rating away from 600. Even although you have a highly less than perfect credit score, you are able to and acquire an unsecured loan of a primary on the internet financing platform such as for instance BadCreditLoans.

not, if for example the credit rating are over 620, you will have an elevated chance of bringing a bigger financing having straight down rates.

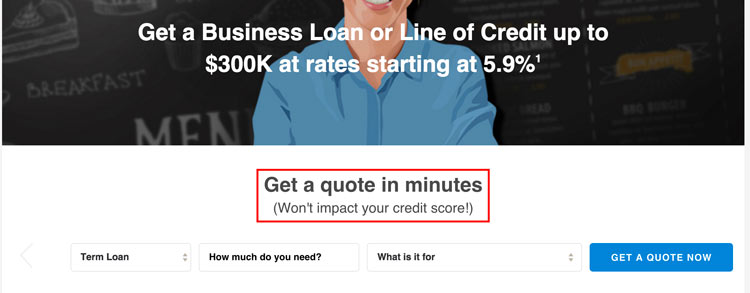

In advance of authorizing an effective unsecured consumer loan request, extremely on the internet credit functions manage a gentle credit assessment. A soft credit score assessment takes never assume all moments and also zero effect on your credit rating. In the event that a crisis lender agrees to deliver your a loan as opposed to powering your borrowing, you should desired the mortgage to have a high-rate of interest.

If the lender merely does a mild credit check, applying for crisis fund will have no impact on your credit score. Accepting a lender’s loan offer, however, may have an impact on your credit score. Because taking the loan will raise your outstanding debt, your credit rating will suffer.

The brand new affect your credit rating is lesser, when you yourself have a track record of paying fund punctually and you can keepin constantly your personal debt so you can the lowest. At the same time, for many who go back the newest disaster loan promptly, it helps you alter your credit score. Your chances of acquiring most readily useful fund later on will rise since your credit history enhances.

Believe borrowing funds from a card relationship otherwise someone close if you need a destination-free financing. Borrowing from the bank from a pal or family members is typically a shorter time-consuming, while are not subjected to the serious regards to an effective typical corporate lender.

If you don’t reimburse their relative from inside the conformed-abreast of time, they could sue your. Bad, not paying brand new emergency mortgage might harm your own family’s associations and you can photo.

Sure. Such bad borrowing funds, like many financing, do not require a credit rating. Having disaster activities, zero credit score assessment finance is greatest. The firms the following was confirmed by OLA and the latest Bbb, and they have the best client score.

This is it! These were the finest less than perfect credit financing in the market for you. Choose a lender that can handle your loan application quickly and provide you with a loan amount that suits your demands. Look for these crisis loan lenders if you have a low credit score since they provide bad credit loans.

This means that, even though you enjoys a decreased credit history, you may want to discover him or her

- Actually people with poor credit possess alternatives

There was a simple on the web application that you could complete in minutes. As long as you meet our very own basic standards, you are able to apply for a personal bank loan that suits their demands.

For those candidates, PersonalLoans provides an alternative. The company’s lender network allows consumers with negative credit to demonstrate their capacity to repay a loan and repair their credit rating while giving them the finances they require.

Consequently, even though you has actually the lowest credit rating, you may located him or her

- To the earlier in the day 3 months, here are the income glides

You’re ideal legal of your own finances. Prior to taking aside that loan, you will want to work out how far EMI you might deal with. You can reduce your EMI through the elimination of along the mortgage. To lower the EMI, you could reduce the term of mortgage. Remember, yet not, one a lengthier-identity form deeper desire outflow. You really need to seek to pay the mortgage entirely immediately after 6 months, when the prepayment penalty is no longer related, as a question of caution.

Consumers that happen to be struggling to get back the loans to their 2nd income apparently obtain again, resulting in a personal debt period.

The lender will determine how quickly you can get an emergency loan. Some emergency loan lenders provide cash the next day, while others provide same-day services. Banks and other traditional lenders might take days or weeks to process a loan.